What Employers Need To Know

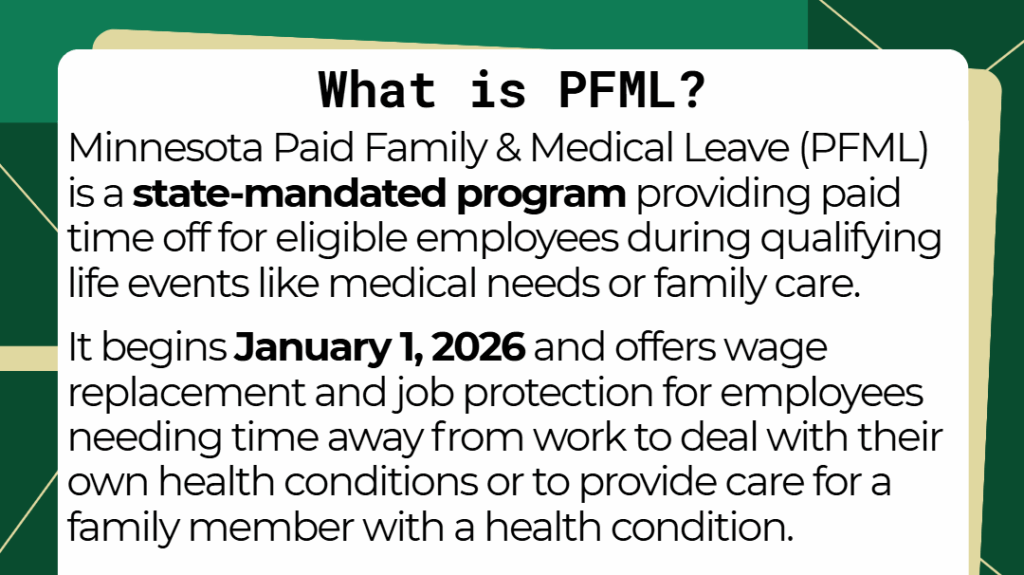

Minnesota’s Paid Family & Medical Leave (PFML) program goes live January 1, 2026. Between now and then, employers need to decide on a plan (state or private equivalent), prepare payroll systems, and complete required notices and postings. Below is a concise, practical guide—plus “what to expect” insights from states already running PFML.

Background & National Context

Minnesota’s new Paid Family & Medical Leave program starts January 1, 2026 — joining a wave of states expanding benefits for workers and families. With no pre-funding and big changes ahead, employers can learn from other states’ successes and challenges. Get the details and what it means for Minnesota businesses in our latest blog 👇

📅Key Dates to Know

- November 10, 2025 – Employers will be auto-enrolled into the state-run plan unless a private plan is selected and approved.

- **Private carriers may have closed applications for January 1 start dates. Contact your group benefits agent for current, updated information**

- December 1, 2025 – Employers must notify employees about this program and what it means for the employee. If you’d like, use this short video that could serve as part of your required notification to each employee.

- December 1, 2025 – PFML workplace poster(s) must be displayed for all employees to see.

- Order them for free via Minnesota’s DLI’s workplace posters portal.

- Download and print the posters – 8.5”x11” is the minimum size allowed

- Email dli.post@state.mn.us. You must include your business name, contact name, mailing address, phone number, and specify which posters and quantities you need.

- January 1, 2026 – Payroll deductions for contributions begin.

Who Is Covered (and who isn’t)

PFML covers most Minnesota employees (full-time, part-time, seasonal). Coverage is based on where work is performed: you’re covered if you work at least 50% of your time in Minnesota (or, if no single state ≥50%, you’re covered if you live in Minnesota).

Not automatically covered / special cases

- Self-employed & independent contractors: not covered by default but may opt in.

- Certain federally covered groups (e.g., federal employees/railroad) are outside state PFML programs’ scope in general; Minnesota’s program materials focus on MN-worked wages and UI-aligned wage reporting. Employers not in UI must create a Paid Leave Only account to file wage detail.

PFML Coverage for Out-of-State Employees

Minnesota’s PFML law ties coverage to where the work is performed, not just where the business is headquartered.

- Employees working primarily in Minnesota → Covered under MN PFML.

- If 50% or more of an employee’s work hours are in Minnesota, they are automatically covered.

- If no single state makes up 50% of their work, then their state of residence decides coverage.

- Employees working primarily in Wisconsin → Not covered under Minnesota PFML.

- Wisconsin does not have a statewide PFML program (as of 2025).

- Those employees will not pay into Minnesota PFML, nor will they receive benefits from it.

- Mixed-location employees (e.g., sales reps, drivers, or hybrid workers crossing state lines):

- Employers must track where hours are worked.

- If time is split, and no single state hits the 50% threshold, then the employee’s state of residence determines coverage.

Covered Reasons for Leave & Duration

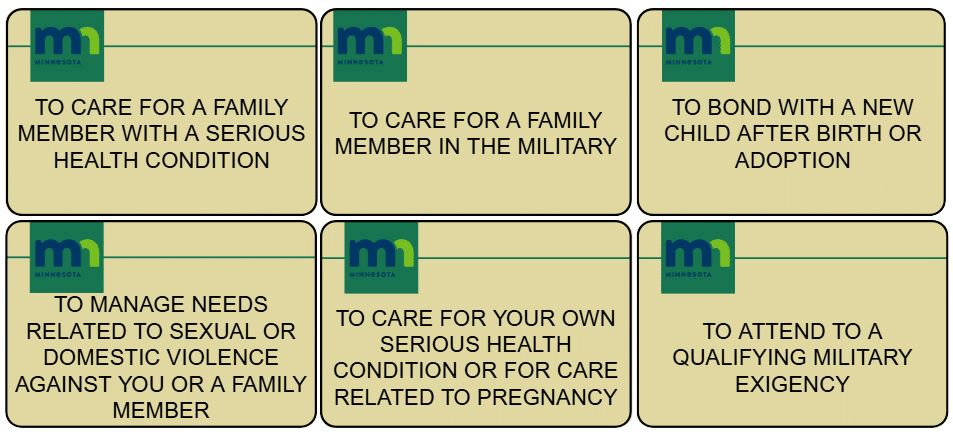

Minnesota PFML provides up to 12 weeks of Medical Leave (your own serious health condition) and up to 12 weeks of Family Leave (bonding, caring for a family member, certain military-related needs, and safety leave related to domestic violence/sexual assault/stalking). Combined cap: 20 weeks per benefit year.

What Documentation Is Required to Approve a Claim?

Every leave type requires certification/verification:

- Medical leave (self): certification from a health care provider that the condition prevents regular work and the time needed.

- Caring leave (family): family member’s provider certifies the medical necessity and time needed.

- Bonding leave: documentation from a health care professional or adoption/foster agency confirming birth/placement.

- Military family leave: active-duty orders or official documentation.

- Safety leave: documentation from appropriate service providers (when applicable).

For more detailed, in-depth documentation requirements, head over to www.paidleave.mn.gov/

(Tip: Align internal processes with FMLA best practices—timely requests for certifications and clear tracking—so HR isn’t reinventing the wheel.)

Wage Replacement (Employee Benefits)

Minnesota benefits replace roughly 55%–90% of wages (up to a weekly max set at the state average wage).

Contributions & Small-Employer Relief

- 2026 total premium: 0.88% of wages, funding both medical (0.61%) and family (0.27%) leave. Employers may deduct up to 50% from employees and must pay the rest.

- Small-employer reduced rate: Employers with ≤30 employees and average wages <150% of statewide AWW pay a reduced premium. Employees’ share is still permitted up to 50% of the total.

State vs. Private Equivalent Plan

You may stay in the state plan or submit an equivalent plan (carrier-insured or self-insured with bond) that meets or exceeds state benefits. Plan changes must align with approval windows and quarter starts; equivalent plans are approved and administered under DEED rules.

Required Employer Actions (Minnesota)

- Decide plan (state vs. private equivalent) and file by Nov 10, 2025 if going private for 1/1/26.

- Post the PFML poster and deliver written notices to employees by Dec 1, 2025 (include primary-language versions where applicable).

- Set up payroll to begin contributions Jan 1, 2026; first payment due Apr 30, 2026.

- Register/report wages (UI joint account or Paid Leave Only account if not in UI).

“What to Expect” from Claims & Administration

Lessons Shared from Other PFML States

While Minnesota is new, other states offer helpful benchmarks:

- Washington (WA PFML) – Applications have increased while processing times trended downward; the target is ~2 weeks from application to payment, though staffing has constrained consistency.

- Oregon (Paid Leave Oregon) – Average ~29 days from application to first payment, with heavy employer/employee inquiry volumes during rollout.

- Massachusetts (MA PFML) – FY2024 data shows reimbursements to employers and robust reporting on claims volume.

- New Jersey (TDI/FLI) – Timeliness fluctuates; highlights importance of complete documentation.

- Connecticut (CT Paid Leave) – In early years, >$448M in benefits paid, reflecting high bonding/medical leave demand.

Takeaway for Minnesota employers: Expect high bonding and medical claims, increased HR traffic during the first year, and that complete documentation is the #1 driver of faster decisions and payments.

Common Claim Types You’ll See Most

- Bonding (birth, adoption, foster)

- Serious health condition (employee)

- Care for family member with a serious health condition

- Military family reasons

- Safety leave (domestic violence/sexual assault/stalking)

HR Playbook: Verifying & Managing Claims Smoothly

- Standardize certification packets by leave type.

- Set timelines and reminders for employees to return certifications promptly.

- Coordinate PFML + FMLA + PTO to avoid overlap confusion.

- Train supervisors on non-retaliation, job protection, and where to route questions.

Quick FAQ (Minnesota)

- How much does PFML cost?

2026 premium is 0.88% of wages; employers may deduct up to 50% from employee pay. Small employers may pay a reduced rate. - Can we switch between state and private plans?

Yes—via DEED’s equivalent plan process. - What exactly must we post and when?

The official DEED PFML poster by Dec 1, 2025, in English and any language that is the primary language of five or more employees.

How PFML, FMLA, and Short-Term Disability Interact and Overlap

PFML (state program)– Provides partial wage replacement and job protection for qualifying family or medical events (your own condition, caring for family, bonding, military, or safety leave).

FMLA (federal law) – Provides job protection only (unpaid) for similar events; ensures reinstatement and continued health coverage. Runs concurrently with PFML when both apply.

Short-Term Disability (private insurance) – Provides income replacement for your own medical condition (illness, injury, or childbirth recovery), and can supplement PFML benefits for medical leave.

In practice:

An employee having a baby may use Short Term Disability for postpartum recovery, PFML for wage replacement and bonding, and FMLA for job protection — all at the same time.

How Reliable Insurance Agency Can Help

At Reliable Insurance Agency, we know Minnesota’s PFML rollout is a big shift for employers and employees alike. While no one has all the answers yet, our team is prepared to help you sort through the complexities, point you toward the right resources, and get your business ready for what’s ahead. With decades of experience, strong community ties, and a commitment to practical guidance, we’ll be here to support you every step of the way.

About Reliable Insurance Agency

Since 1974, Reliable Insurance Agency has proudly served businesses and families across northern Minnesota and Wisconsin, providing Professional Services and a Hometown Feel. With offices in Cloquet, Hermantown, and Superior, our team helps employers navigate complex topics like compliance, employee benefits, and risk management, while also offering a full range of business insurance and employee benefits solutions and personal insurance. If you have questions about PFML, FMLA, or how these changes affect your business, we’d love to talk!

Contact us today to learn how we can support your company and your employees.