What is HO-6 Condo Insurance? And what does it cover?

If you own a condo or townhome in Duluth, Superior, Cloquet, Hermantown, or anywhere in Northern Minnesota or Northwest Wisconsin, you probably assume your association’s “master policy” has you covered.

It does—but only part of the way.

To protect the parts of your unit you’re responsible for, plus your belongings and liability, you’ll typically need an HO-6 condo policy. Knowing where the association’s coverage stops and your HO-6 starts is one of the most important insurance questions for condo and townhome owners in our region.

What Is an HO-6 Condo Policy?

An HO-6 policy is a homeowners policy designed specifically for condominium and co-op unit owners. It typically covers:

- The interior finishes of your unit (depending on your master policy language)

- Your personal belongings

- Your personal liability

- Additional living expenses if you can’t live in your unit after a covered loss III

In Wisconsin, the Office of the Commissioner of Insurance describes HO-6 as a package policy specifically for condo owners that usually covers personal property and may include improvements and alterations not insured by the association. OCI

Industry experts, including carriers we work with – like Travelers, Safeco or Auto Owners – describe HO-6 as coverage that works alongside the association’s master policy by protecting your unit’s interior, your belongings, and your personal liability.

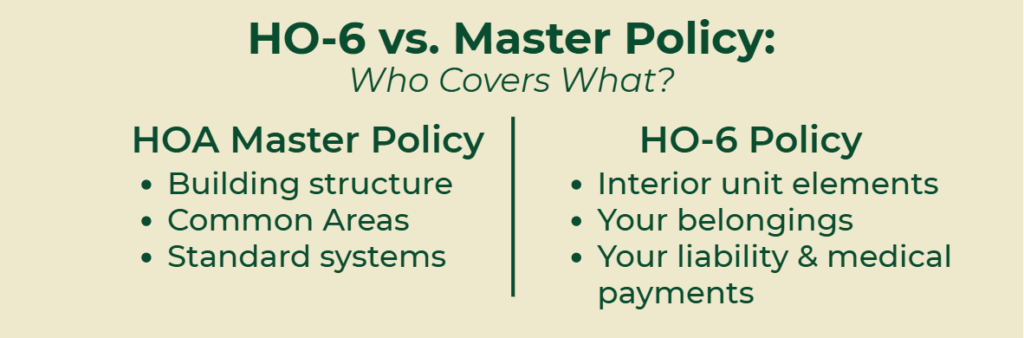

Master Policy vs. HO-6: Who Covers What?

To understand your risk, you have to start with the master policy held by your association or HOA.

In Minnesota, condo associations typically carry a master policy that covers shared property—exterior walls, roofs, common hallways, lobbies, and shared systems. FSR In Wisconsin, regulators make a similar distinction, noting that the association insures common areas while individual unit owners use HO-6 policies for their own property and improvements. OCI

Most master policies fall into one of three buckets:

- Bare walls (or “walls-out”)

- The association covers the building structure and common areas.

- You’re responsible for all interior finishes: drywall, flooring, cabinets, fixtures, and any upgrades.

- Single-entity / all-in (including original finishes)

- The master policy covers the building plus the original interior finishes.

- You’re responsible for improvements and betterments (upgrades) and your belongings.

- Modified versions

- Some policies blend these approaches, which is why reviewing your condo documents is essential.

Think of it this way:

- The master policy usually covers what everyone shares.

- Your HO-6 policy covers what is uniquely yours—your space, your stuff, and your liability.

Why HO-6 Matters So Much in MN & WI

1. High Master Policy Deductibles

Across the country, condo associations have been raising deductibles: many now sit at $10,000–$25,000 or more. BPM

In practice, that means:

- If a storm damages your building’s roof, the association may assess part or all of that deductible back to unit owners.

- Without enough loss assessment coverage on your HO-6, you may have to pay hundreds or thousands of dollars out of pocket.

With our region’s history of wind, hail, and heavy snow, large deductibles and special assessments are becoming more common. That’s why many condo experts recommend loss assessment coverage as a core part of a well-designed HO-6 policy.

2. Northland Weather: Wind, Snow, Ice & Water

Northern Minnesota and Northwest Wisconsin see:

- Lake-effect snow

- Heavy ice and freezing rain

- Strong wind off Lake Superior

- Rapid freeze–thaw cycles

These conditions increase the risk of:

- Roof leaks into upper units

- Ice dam damage to ceilings and walls

- Water intrusion through windows, decks, or siding

A typical HO-6 policy, when properly tailored, can help cover interior damage to your unit (like drywall, flooring, and built-ins) if the cause of loss is covered and the association’s master policy doesn’t pick up the full tab.

Carriers that Reliable Agency works with, such as Auto-Owners, highlight that condo insurance is designed to cover the condo or structures you’re responsible for plus your personal possessions and liability.

3. Your Personal Property & Liability

Your condo association does not insure your personal belongings.

A standard HO-6 policy provides personal property coverage for your furniture, clothing, electronics, and other household items, usually on a named-perils or “all-risk” basis depending on how it’s written. III

It also provides:

- Personal liability coverage if someone is injured in your unit or you accidentally damage someone else’s property

- Medical payments to others for minor injuries to guests, regardless of fault Travelers

For condo and townhome owners in busy buildings near Canal Park, downtown Duluth, or central Superior, this liability protection can be just as important as coverage for the unit itself.

Key Coverages to Look For in an HO-6 Policy

Here are several important coverage areas to review with your independent agent:

- Dwelling / building property coverage (Coverage A)

- Covers the interior parts of your unit you’re responsible for: walls, flooring, cabinets, built-ins, and upgrades.

- Personal property (Coverage C)

- Pays for your belongings if they’re damaged or stolen due to a covered peril.

- Consider replacement cost coverage rather than actual cash value. NerdWallet

- Loss of use / additional living expense

- Helps pay for temporary housing and extra costs if your unit is uninhabitable after a covered loss. Travelers

- Personal liability & medical payments

- Protects your assets if you’re sued over injuries or property damage, and helps pay smaller medical bills for guests. Travelers

- Loss assessment coverage

- Helps pay your share of covered assessments from the association—especially important when master policy deductibles are large or when a claim exceeds the association’s limits.

- Special limits & endorsements

- High-value items like jewelry, collectibles, or fine art are often subject to sub-limits. You may need scheduled personal property coverage. NerdWallet

How to Right-Size Your HO-6 in Minnesota & Wisconsin

Here’s a simple roadmap you can follow before your next renewal:

- Get your association documents

- Ask for:

- The master policy declaration page

- The section of your bylaws or declaration that describes insurance responsibilities

- Ask for:

- Determine your master policy type

- Is it bare walls, single-entity/all-in, or a hybrid? That drives how much interior coverage you need.

- Review the master policy deductible & assessment rules

- Check whether the association can assess deductibles or uncovered costs back to unit owners, and if so, how.

- Estimate the cost to rebuild your unit’s interior

- Think about today’s construction prices in the Duluth–Superior market for things like cabinets, flooring, and drywall.

- Work with an independent agent who knows our region

- An agent who understands Northland weather, local construction costs, and the condo market can help you select limits and endorsements that make sense for your building and budget.

The Bottom Line

For condo and townhome owners in Minnesota and Wisconsin, an HO-6 policy isn’t just a box to check for your lender—it’s the piece that makes your protection complete:

- Your association’s master policy protects the building and common areas.

- Your HO-6 policy protects your interior, belongings, liability, and often your share of big deductibles or special assessments.

If you haven’t compared your HO-6 coverage to your master policy in a while—or you’re not sure what kind of master policy your association carries—this is a great time to review it with a local independent agent who understands the Duluth–Superior, Cloquet, and Hermantown market.

Contact Reliable Agency Today!

If you’re unsure what your condo or HO-6 insurance policy covers – or simply want a second set of eyes – our advisors are here to help. We’ll take the time to review your coverage, explain it in plain language, and make sure it aligns with your actual risks.

With offices across the greater Twin Ports region, we understand the unique exposures that come with living here. From weather-related perils to shared-structure considerations and how to insure against them properly, we can help you determine what type of insurance is right for you. Reach out today to start a conversation and gain confidence in your coverage.

Read More About Condo Insurance

- Auto-Owners Insurance: Condo Insurance Overview. Auto-Owners Insurance

- Insurance Information Institute (III): Homeowners Insurance Basics – HO-6 Policy Overview. III

- Minnesota Department of Commerce / FirstService Residential: Insurance Basics for Minnesota Homeowners Associations & Condo Insurance for Associations. FSR

- Wisconsin Office of the Commissioner of Insurance: Condominium Insurance (PI-068) & Consumer’s Guide to Homeowners Insurance (PI-015). OCI

- Travelers Insurance. What Is HO-6 Condo Insurance? Travelers

- Progressive Insurance. Condo Insurance (HO-6) Basics. Progressive

- BPM-MN and Legislative Commission on Housing Affordability (MN). Master Policy Deductibles, HO-6 Policies, and Loss Assessment. Bullseye Property Management

- Business Insider: Condo (HO-6) Insurance: How It Works and What It Covers. Business Insider