Every year, hailstorms cause billions of dollars in damage to vehicles across the U.S. — and northern Minnesota and Wisconsin are no exception. Even a quick summer storm can leave behind dented hoods, cracked windshields, and costly repairs. But does car insurance cover hail damage? And what should you do if your vehicle gets hit?

We’ll break it down so you don’t have to!

Is Hail Damage Covered by Auto Insurance?

YES – but ONLY in you have comprehensive coverage for your vehicle(s). Hail damage is considered a “non-collision” event, and liability coverage alone won’t cut it.

🚘 Quick Coverage Guide: Weather Damage & Auto Insurance

| Coverage Type | Covers Damage From: | Example Scenario |

| Liability | Damage you cause to others — not your own vehicle | You hydroplane in a storm and hit another car |

| Collision | Accidents involving your car hitting something — including weather-related collisions | You lose control on icy roads and slide into a guardrail |

| Comprehensive | Non-collision events like hail, wind, falling trees, flood, fire, theft | Hail dents your hood; wind blows a tree limb onto your roof |

| Uninsured Motorist (UMPD) | Vehicle damage from an uninsured driver (state-dependent) | A driver with no insurance hits your car during a rainstorm |

Not sure what type of coverage you have? Reach out to your agent or login to your online Client Portal. And, if you don’t have either, now would be a great time to call us to get both!

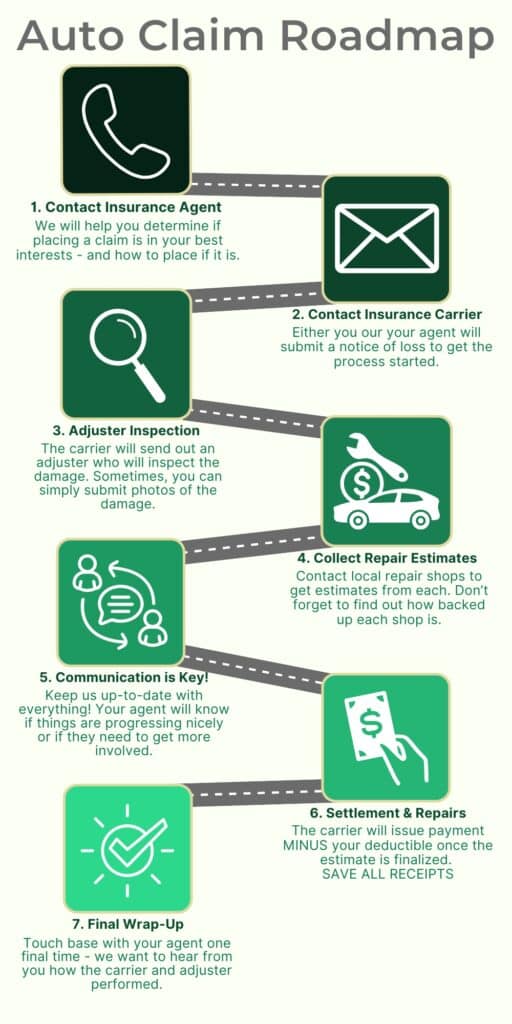

What Happens When You File a Hail Damage Claim?

Here’s what to expect after a hailstorm hits your exposed vehicle:

- Document, Document, Document! Take photos of dents, dings, broken glass, and surroundings.

- File Your Claim. Using your agency’s preferred method of claim following, get this next step completed as soon as possible.

- Assessment. An insurance adjuster must inspect your car to determine repair costs.

- Repair or Replace? If repair costs exceed the car’s value, your vehicle may be declared a total loss.

- Deductible Applies. You’ll pay your deductible first, and then your comprehensive coverage plan will kick in next.

Will Hail Damage Total My Vehicle?

Severe hail CAN do enough damage to make repair costs surpass the Total Loss threshold. In Minnesota, that threshold is 70% of the vehicle’s pre-accident actual cash value. And, if that happens, the insurer will issue a payout based on that pre-storm value.

insurance tip: if you already have existing cosmetic damage – especially other hail damage – the carrier may deny full payment.

Paintless Dent Repair (PDR): Is It an Option?

Many auto body shops use Paintless Dent Repair for hail claims. This method preserves your car’s original paint and is quicker and more cost-effective than full panel replacement.

Not all damage is eligible for PDR. Your adjuster or repair shop will help determine the best method.

Will My Insurance Rates Go Up After a Hail Claim?

In most cases, hail damage claims don’t impact your rates because it’s considered an “Act of God” — something outside your control. But multiple comprehensive claims over a short time period could raise red flags for insurers.

Tips to Protect Your Car From Hail

While you can’t control the weather, a few precautions can help minimize damage:

- Park in a garage or under a carport

- Use a hail blanket or thick blanket in a pinch

- Check the forecast before parking outdoors

- Use weather alert apps for severe storm warnings

[Insert Image: Car under cover, storm clouds, or hailstones on a vehicle]

Reliable Agency is Here to Help!

Hail damage is stressful, but understanding your insurance options makes it easier to recover. If you’re unsure whether your current coverage protects you, we’re here to help review your policy and discuss your options — before the next storm hits.

Need help with a hail claim? Contact Reliable Insurance Agency or start your claim through [CSR24/Reliable 24/7].

Contact us today and see for yourself how Reliable Agency, Inc. provides Professional Insurance Services with a Hometown Feel! Or click to get a quote for whatever insurance services you need! We have offices in Hermantown, Cloquet, and Superior and can meet with you in-person, over the phone, or virtually. We serve clients all across Minnesota and Wisconsin and beyond! We’ll give you peace of mind knowing that your property and most important possessions are properly covered for whatever life throws your way.

asd;flkjasdf;lkjsa