Does Insurance Cover Wildfires?

Northern Minnesota and Wisconsin are known for their beautiful forests. Unfortunately, the recent wildfires that have popped up in northern Minnesota have scorched thousands of acres and destroyed homes, cabins, and vehicles. For those affected, the aftermath brings stress, confusion—and many questions about insurance coverage – like; “Does insurance cover wildfires?” Reliable Insurance Agency has […]

Am I Covered If My Business Is Linked to PFAS?

More and more commercial insurance policies are starting to exclude coverage for PFAS—also known as ‘forever chemicals.’ As this issue gains national attention, businesses here in the Duluth-Superior region are starting to ask: “What are PFAS, and could they affect my insurance coverage? And am I covered if my business is linked to PFAS? Let’s […]

The Importance and Benefits of Life Insurance for Children

By Kristen Goldberg, Life & Health Insurance Agent at Reliable Insurance Agency As parents, grandparents, and guardians, we always want what’s best for our children. We carefully plan for their health, education, and future opportunities—but one area that often gets overlooked is life insurance for children. While it may feel like a difficult topic to […]

Essential Spring Maintenance Checklist

Spring is a season of renewal, but it also brings risks like fluctuating temperatures, melting snow, and increased moisture. To help both homeowners and business owners prepare, we’ve partnered with our disaster recovery specialists, Dryco Restoration Services, to create this Essential Spring Maintenance Checklist. PREVENTING FROZEN PIPES Preventing Frozen Pipes Spring seems to sneak up […]

Does My Insurance Cover Wind Damage?

Wind can occur all across the Northland and causes significant damage to both residential and commercial properties. Understanding your insurance coverage is essential to protecting your investment. In this blog, we’ll break down what wind damage is, what your insurance typically covers, what it doesn’t, and steps you can take to prevent costly repairs. If […]

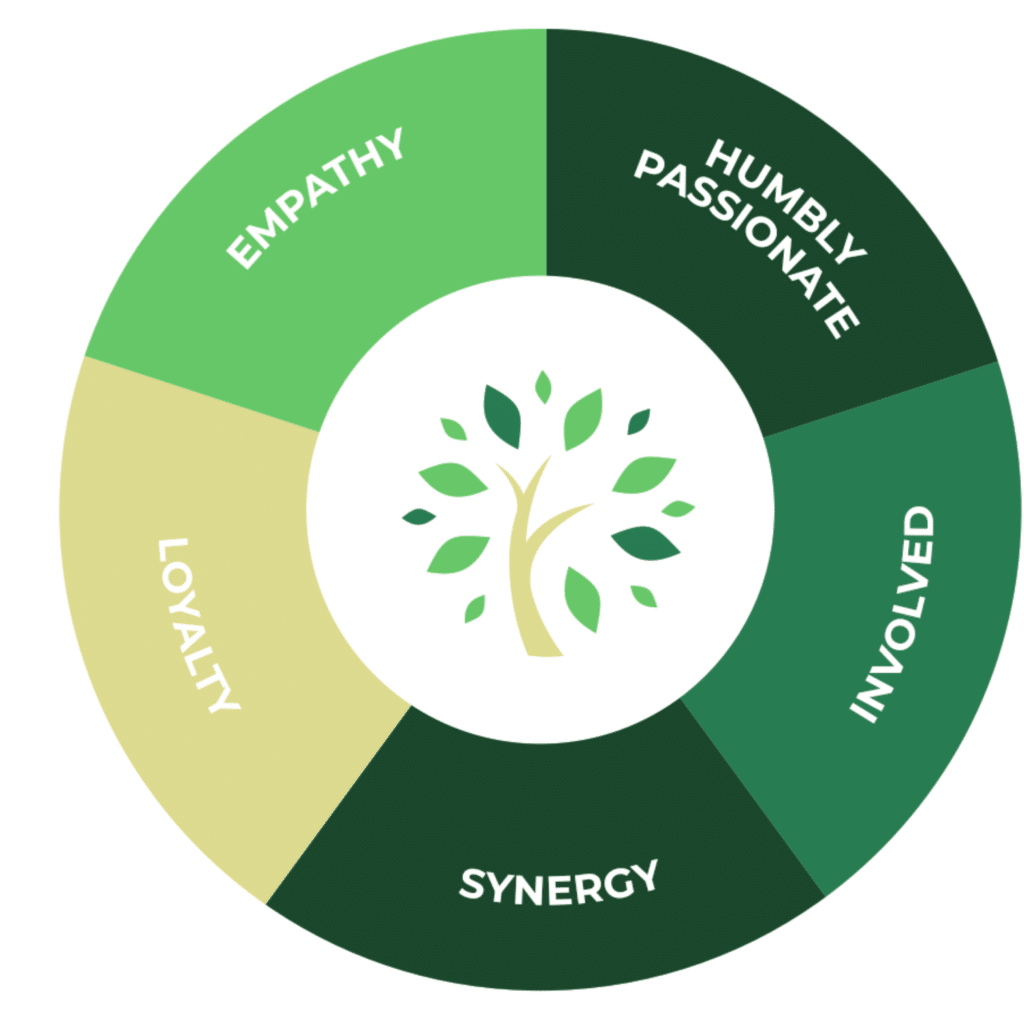

What Drives Reliable Insurance Agency?

At Reliable Insurance Agency, we measure success by more than just policies sold or revenue earned. Success is a much more holistic, all-encompassing concept. Success means cultivating a culture where shared values guide every decision, action, and interaction. These values not only set us apart but also fuel our mission to protect what matters most […]

How to Insure Your Solar Panels

Harnessing the Sun: What You Need to Know About Solar Panels and Insurance As more homeowners and businesses turn to renewable energy, solar panels have become a popular way to save on energy costs and reduce environmental impact. However, before installing solar panels, it’s essential to understand the considerations involved—both practical and financial. At Reliable […]

SBA Surety Bonds Boost Small Business Growth

SBA surety bonds play a vital role in boosting small business growth. Reliable Insurance Agency is a preferred agency of the Small Business Administration’s Surety Bond Guarantee Program. This collaboration reinforces our commitment to supporting small businesses across the entire United States. As advocates for growth, we’re proud to deliver the support and assurance that […]

Insurance for Flood and Water Damage

What Can Hurricanes Helene and Milton Teach Us About Home Insurance? Hurricane Helene and Hurricane Milton left behind a path of destruction, with families and businesses losing what mattered most. Even more alarming is that only 2% of the affected homes had adequate flood insurance. Some homeowners didn’t buy insurance due to the cost, while […]

Cyber Insurance For Your Business

In today’s digital world, small and medium-sized businesses (SMBs) face growing risks from cyber threats. From data breaches to ransomware, every business is a target. Larger companies have big IT teams, but smaller businesses can be more vulnerable. That’s why cyber security and cyber insurance for your business is key to protecting your data, customer […]