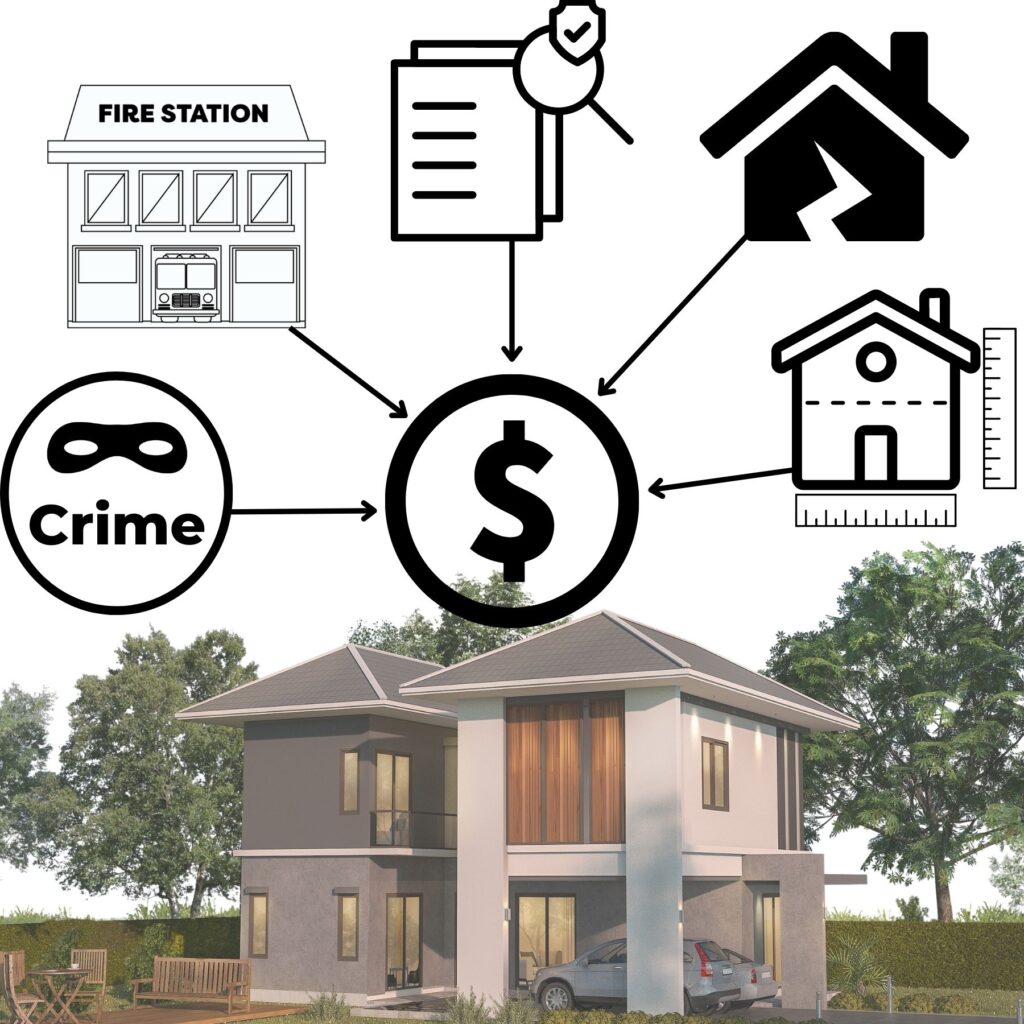

Why do home insurance rates vary so much? It is, in fact, quite common for homes to cost different amounts to insure. There are several factors that go into your insurance rates. Knowing what affects rates may help you when your current policy is up for renewal.

What Factors Do Companies Look At?

- Age of the home

The age of your home can affect your insurance because a newer home is more likely to be in better shape than an older one and is less susceptible of outdated materials causing damage. If you do own an older home, there are some things you can do to help keep your rates down that we’ll discuss later. - Square footage/size of home

The larger the home, the more expensive it is to insure. The types of materials or unique features in your home can also increase the cost. The more expensive the finishings are, (countertops, cabinets, flooring, lighting, etc) the more it will cost to replace. - Your credit score

Homeowners with good credit scores, like those above 750, are statistically proven to file less home insurance claims. Around 45% of scores are 750 and above. Because of the decreased risk of a claim, insurance companies in turn charge them lower rates. But don’t worry if your credit score is one of the 55% of scores that are below 750! There are many things you can do to improve your score. And if your credit score has recently improved, contact your agent. They may be able to run your credit score again to see if your rates decrease. - Recent Claims History

By filing a home claim within the last 3-5 years, your rates may be higher. This is the case because insurance companies view you as more likely to file another claim in the future. This is true for claims related to weather, dog bites, and theft. You may see an even higher increase if you have a liability claim, as there is a chance you could also face a lawsuit, which means added risk for you and your insurance company. Rates may decrease over time, but probably not back to the original rate prior to the claim. - Coverage Types

Do you have a larger garage or outbuilding that requires more insurance than a standard two car garage? What is your deductible? The higher the deductible you have, the lower your premium may be, as you would be responsible for more out of pocket expenses as the result of a claim. Home policies also offer different liability levels. Options may be anywhere from $100,000 to $1 million, and the higher your liability coverage, the more premium you will pay. Many polices also have add-on coverages, commonly referred to as endorsements, that can increase your coverage at an additional cost. This includes scheduled items such as jewelry, firearms, or family heirlooms. Or it could be coverage for water backup, buried utility lines, ID theft, other coverages that may be offered. - Items of Special Concern

These are items that can place the homeowner at a higher risk for having a claim. Some examples are wood stoves, swimming pools, trampolines, or certain breeds of dogs. Many times, companies will charge additional premiums for these items since they pose additional liability risks. - Distance From A Fire Station/Hydrant

The closer you are to a fire department or even a hydrant may mean you pay less for insurance, since the response time for a fire emergency is quicker and can prevent further damage from occurring.

What Can You Do To Decrease Rates?

- Update the Electrical and Plumbing Systems

Outdated wiring or plumbing pose as higher risks of fire and water damage. By updating these systems, you reduce your risk of a loss caused by old, outdated or out-of-code systems.

- Increase Policy Deductible

This obviously will cause you to be responsible for a larger portion of any claim, but your premium would drop as your deductible increases.

- Install a Home Security System

A reliable home security system is a smart move both for your own safety and for your bank account. Many insurance companies offer discounts because these systems act as a deterrent to theft, vandalism and property damage. Alarms, sensors, and cameras can each reduce your risk of suffering a break-in. Some security systems even offer early detection and warning for fire.

- Bundle Your Policies

Talk to your agent to see if your policies can all be bundled with one company. Discounts can be as high as 25%!

- Upgrade the Roof

Installing a new roof can make a big difference! A properly installed new roof can help prevent water intrusion and protect your home from damage. The up-front cost can be significant, but the savings can be anywhere from 5% up to as high as 35%. It all depends upon the type of roof, your location, and what your carrier offers.

Home insurance rates are not as simple as it may appear at the surface. But Reliable Agency is here to help you find the best plan for your unique situation. With offices in Hermantown, Cloquet and Superior, our agents are conveniently located to help the entire Twin Ports and surrounding communities. Speak to one of our Personal Lines staff today to find out how we can help you live more joyfully!