Our January 31 blog identified the different types of life insurance. Now, we would like to explore the question many ask. “How much life insurance do I need?”

What are your financial obligations? Do you have outstanding debt like a mortgage, auto loans or school debt? How much income would you like to have covered? What about final, end-of-life expenses? Did you know funeral costs can exceed $10,000? Are you saving for, or already paying for, your children’s school tuition? Take inventory of all your debt, investments and charitable contributions. The sum of all these considerations will detail just how important a life insurance policy really is. Of course, each person’s answers will vary. That is why it is important for each individual to determine what is most important to them.

Two Common Ways to Estimate Your Needs

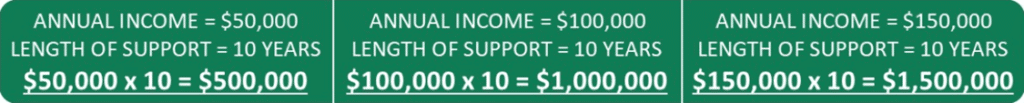

1. Multiple of Income

This is a very basic method to estimate your life insurance needs. Using this method, you are only looking to replace your salary for a planned period of time. To start, simply multiply your annual income by how many years you want to support your beneficiaries. Here are three examples of how it works.

This is a simplified approach, and it doesn’t consider the unique situations of your beneficiaries. Things like their income, investments, or other expenses may cause you to want to adjust this amount. It is recommended to have seven to ten years of life insurance at a minimum. This approach may work well for you and your spouse/partner but not for your children or other beneficiaries. It also does not account for inflation, taxes, or other changes to future income or expenses. This method is a general estimation of how much you will want to have. But you will want to meet with your insurance advisor to determine a more accurate amount.

2. Income Needs

This is a more common and comprehensive option that focuses on more than just income. For example, it also looks at the financial situation of your beneficiaries. It is more detailed than the aforementioned approach and gives you a more accurate picture of what is needed. Most of the needs of your benefactors will fall into one of these two categories.

- Cash Needs

- Final, end-of-life expenses

- Debt reduction or pay-off

- Tuition expenses

- Emergency funds for unexpected expenses

- Mortgage or business loan payments

- Income Needs

- Family dependency: individuals that depend on you for financial support

- Preretirement: those you intend to list as benefactors are not yet of retirement age

- Retirement: your surviving partner or spouse is of retirement age and no longer working

You can also use Auto Owner’s free calculator to help you determine how much is enough life insurance. After determining the income needs of your survivors, subtract any other sources of income they may have. This includes savings accounts, investments, IRA or 401K accounts, or other similar accounts. Once this is compiled, you will have an accurate estimate for your life insurance needs. Asking yourself the question, “How much is enough life insurance?” is an important first step as you plan for the future.

Reliable Agency, Inc. is a trusted, local Big i Minnesota member capable of helping you find customized insurance solutions. Contact Andy Micke or any of Reliable Agency’s Life & Health agents for additional information or to get a quote today!